The Money Skills Resource Hub for Primary Schools

Engaging

Fully-Resourced

Cross-Curricular

Becoming money smart is an essential life skill. But with children forming attitudes to money between ages 5-10, most financial education simply happens too late. We’re on a mission to change that. Our online resource hub is packed with tried-and-trusted lessons that any teacher can use to help transform the next generation’s money confidence.

Who We're Already Working With

Why Tykeoons?

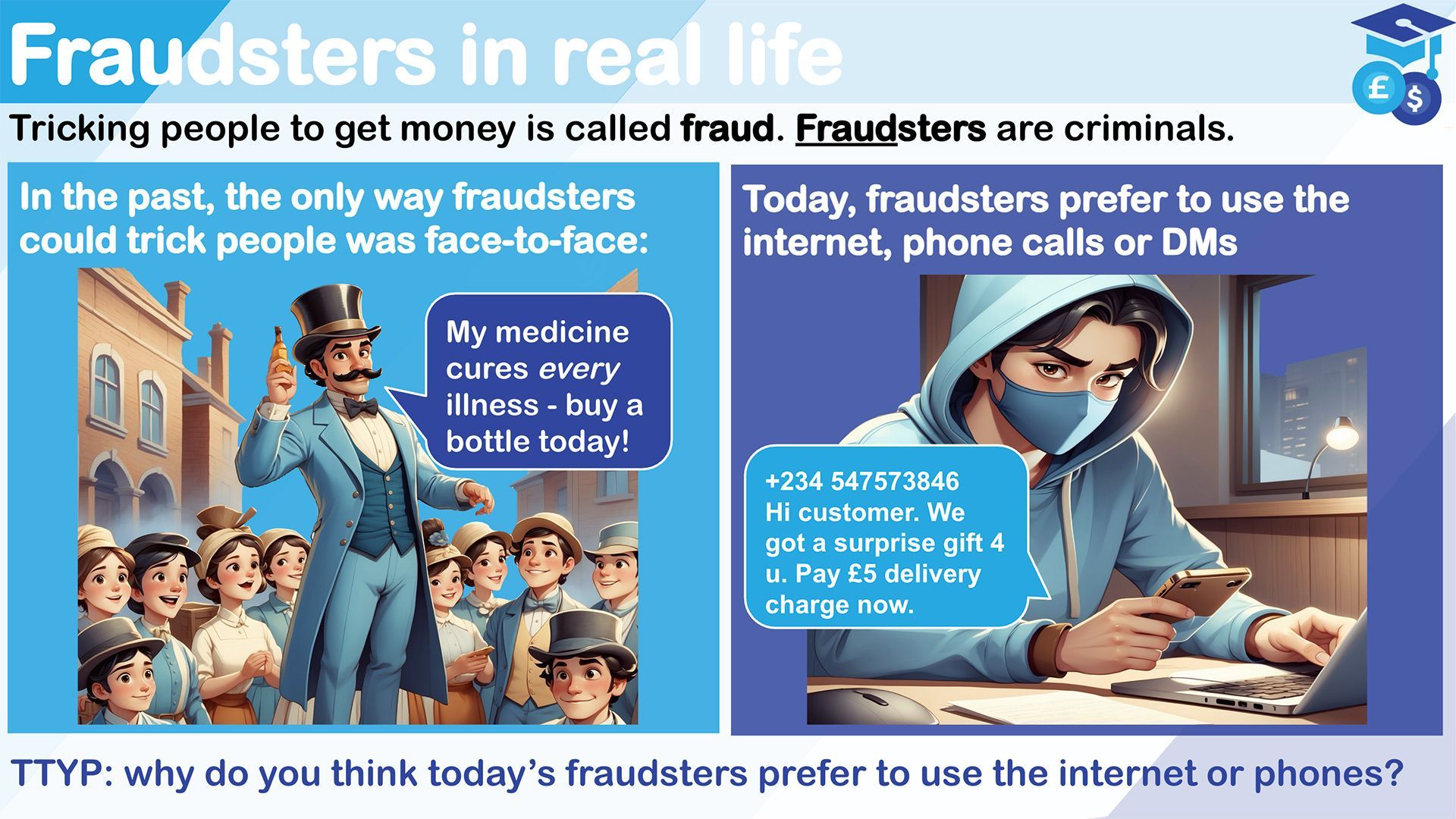

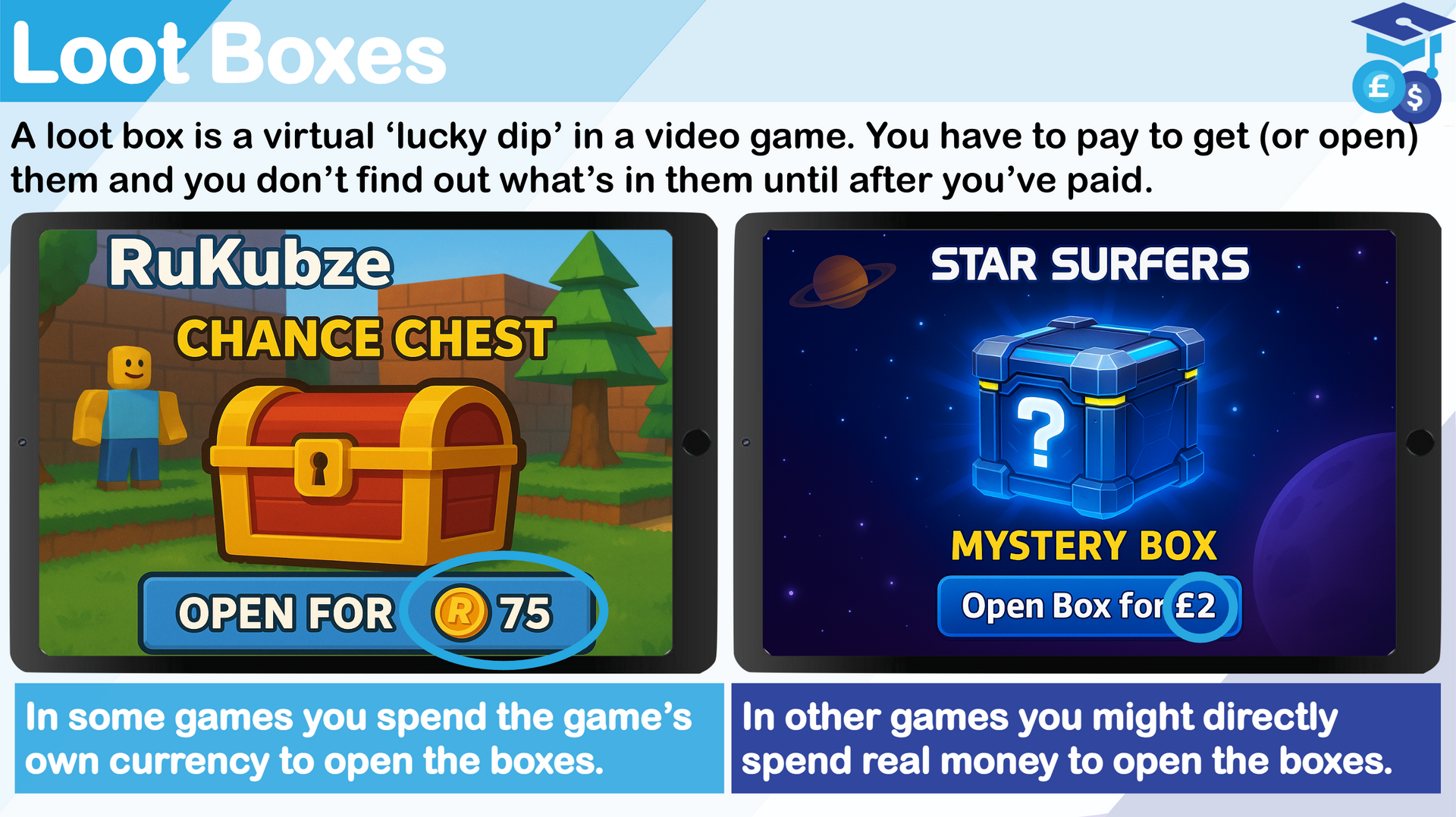

From spotting a scam, to making a budget, to learning why coins were invented, our resources cover a vast range of topics across money management, economics and even how to start a business!

Whats Inside?

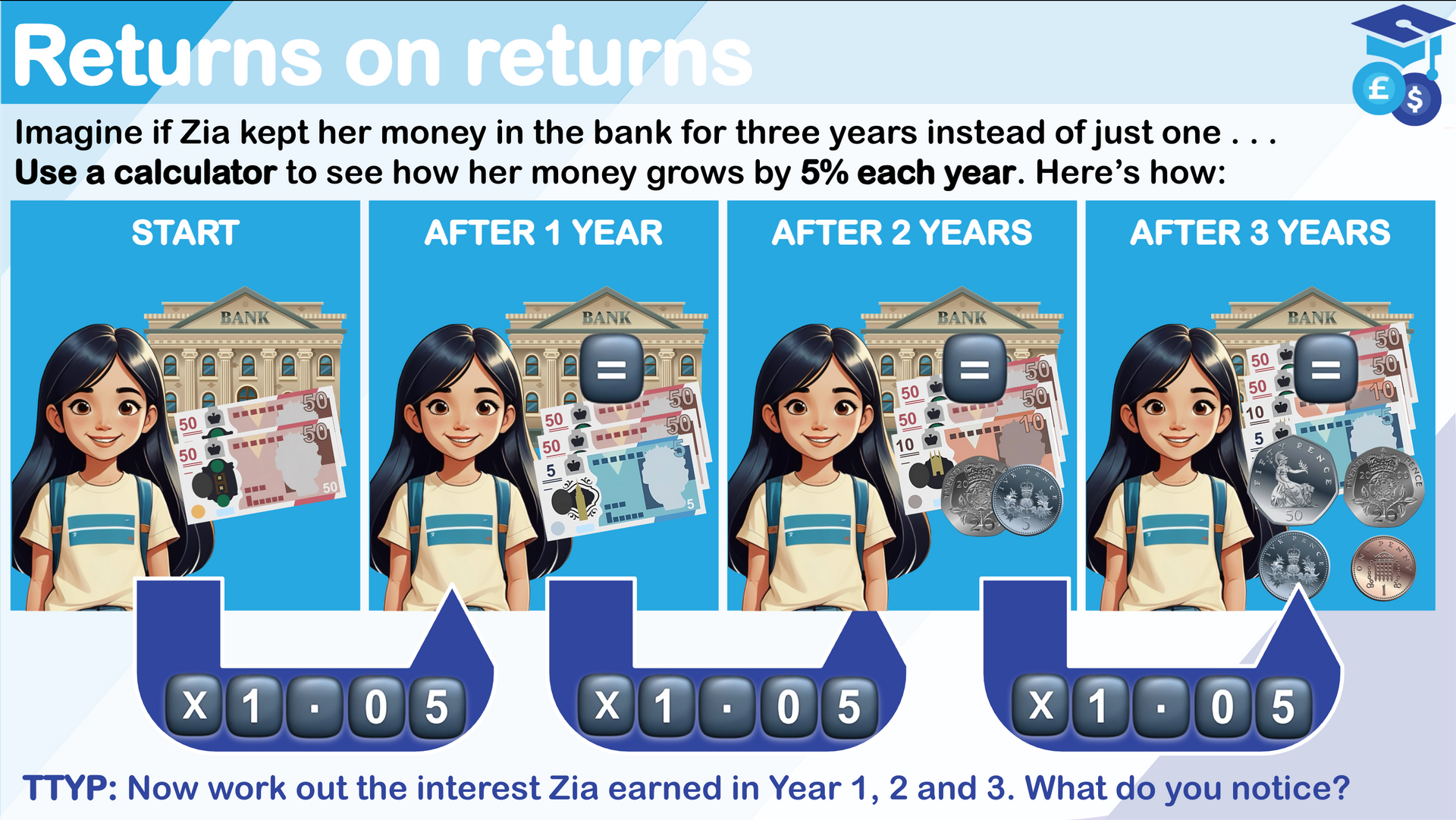

MoneySmarts®

The essential financial education programme for Reception to Y6. Everything from what money is to compound interest.

MoneySmarts® fully covers Young Enterprises's 4-11 Financial Education frameworks, and has been awarded the prestigious Financial Education Quality Mark.

JuniorNomics

A cross-curricular programme introducing Y3-6 pupils to the 'big picture' of how money works in the world. From supply and demand to what the Bank of England does, JuniorNomics gives pupils a new outlook on their learning in history, citizenship and PSHEE.

The Enterprise Lab

A 7-part module for Y6 on how to start and run a business. Through hands-on learning, guide your pupils to plan and produce products, pitch for investment (with the help of some visiting parents!) and make real profits at a school event, such as your summer fête!

Resource Bank

Our platform hosts dozens of individual resources you can use to embed financial education across your school. From money-themed maths investigations, to puzzles, to assemblies, these bring financial thinking into multiple subjects and reduce teacher workload - a win-win!

How It Works

Bringing financial literacy to life with engaging, ready-to-use lessons

1.

Instant Access to Resources

Once signed up, you’ll have access to hours of ready-made content, accessible through any desktop browser.

2.

Engaging, Interactive Lessons

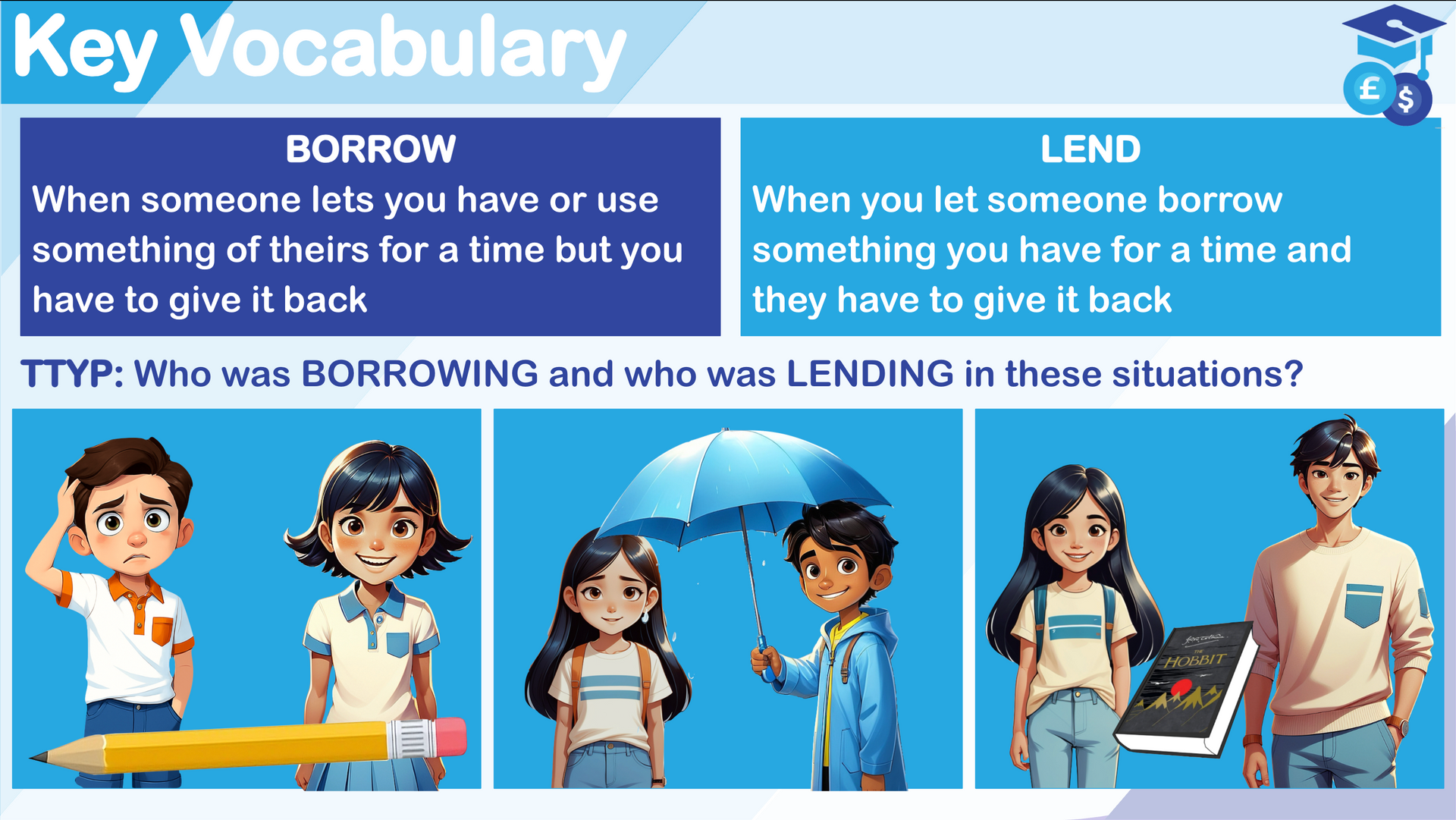

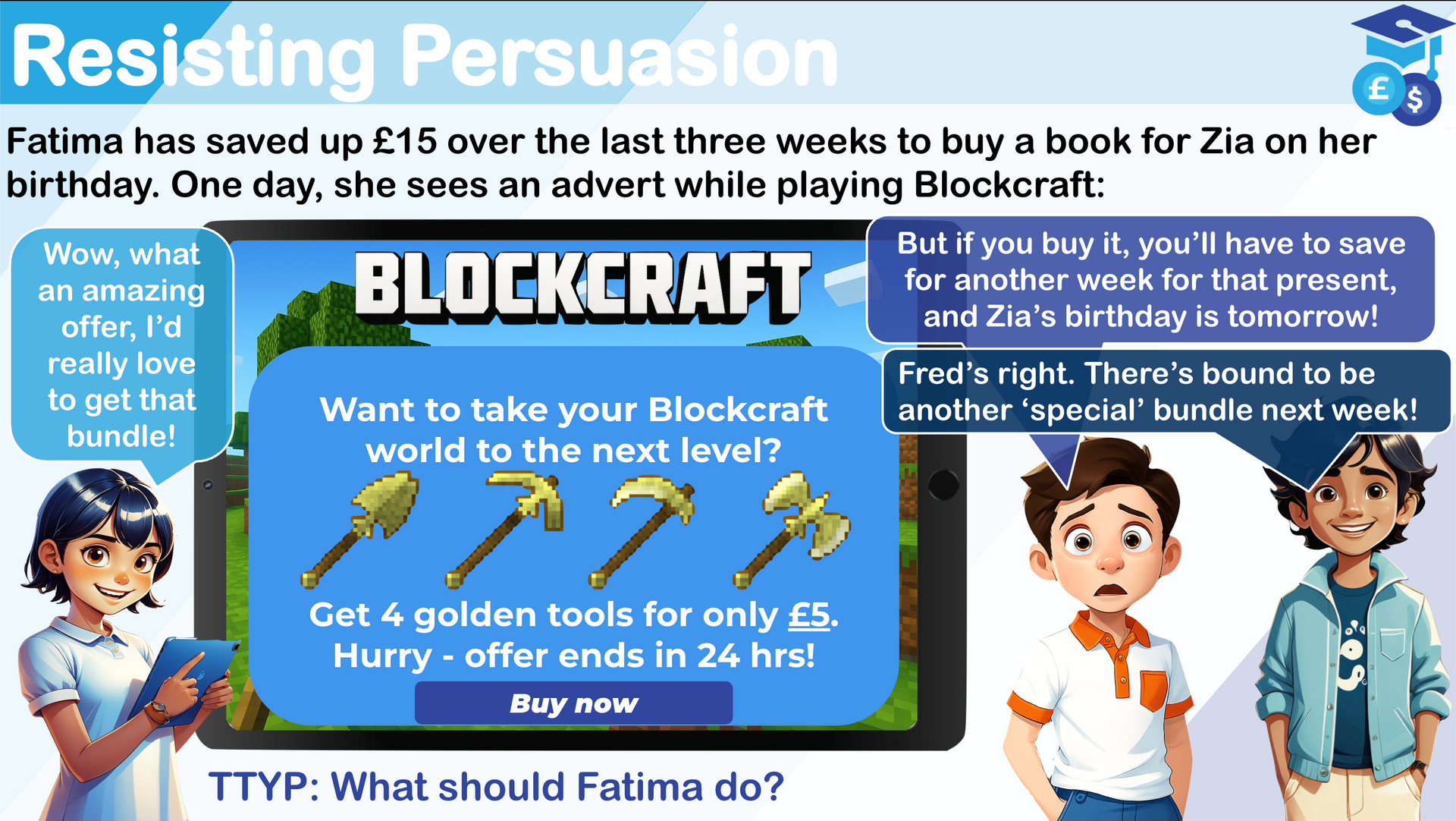

Our three main programmes include slide decks, guided discussions and child-relatable examples to make financial and economic concepts relevant and memorable to pupils.

3.

Hands-On Activities

Each lesson comes with ready-made printables, with three levels of challenge to adapt to the needs of your classes. There are ‘no-printing-needed’ options within each lesson for those who need them!

4.

Progress Tracking

Our resources are designed by real teachers with a deep understanding of pedagogy. They are light on text and rich on visuals, to bring learning to life for all learners.

Who Is It For?

Our approach ensures that children don’t just learn about money—they develop the confidence and skills to make smart financial decisions in real life.

For Teachers

We’ve spent hundreds of hours making these lessons, so that you don’t have to. Tykeoons provides fully-resourced, interactive and differentiated content that can slot into existing schemes of work (e.g. maths, PSHEE, computing and even history). We’ve designed things so you don’t need special training or prior knowledge to deliver it.

For Parents / Tutors

For homeschooling parents or tutors, Tykeoons provides a plug-and-play package that equips you with the tools you need to support your child's financial education in a way that is fun, interactive, and easy to follow.

For Schools

2025’s Curriculum and Assessment review called for mandatory financial education in primary schools from 2028. Tykeoons provides a seamless solution to get ahead of this requirement and to instill lifelong money confidence in the pupils you have today. No fancy apps, no extra screen time and no need to find new slots in an already packed timetable.

Why Money Lessons Can't Wait

Starting Early Changes Everything

Financial and economic literacy is a weakness in UK education. We’re on a mission to change that.

Did you know . . .

- Only 48% of UK adults have basic financial literacy skills

- Young adults are three times likelier to fall victim to a scam if they didn’t have any financial education

- 35% of working-age UK adults have nothing saved for retirement

- Those with the highest financial wellbeing in Britain enjoy an average of 19 years longer life expectancy than those with the lowest

- Cambridge University (2013) found attitudes and habits related to money are formed from as young as seven years old

- The University of Wisconsin (2015) found that primary-age children are capable of learning and retaining important economic and financial knowledge

- The University of Michigan (2018) found that if poor money habits are not challenged between the ages of 5-10, they are likely to become permanent

Get Started for Free

Active Pilot – Free School Subscription

We believe every primary school pupil deserves access to high-quality financial and economic education. Our free Active Pilot subscription allows schools to meaningfully pilot Tykeoons by teaching real lessons with real pupils.

Your Active Pilot includes:

- Access to all MoneySmarts® lessons for Y3 and Y5

- Access to all JuniorNomics lessons for Y3

- The full curriculum map for both programmes

- Up to a year’s access

- Continued access is automatically unlocked each term through active use of the platform

Schools typically use the Active Pilot to evaluate Tykeoons before rolling it out across further year groups.